AnarchicCluster

Well-known member

https://medium.com/@seweso/the-four-horsemen-of-the-bitcoin-apocalypse-eaa4d15636e8#.p6ax7vsfp

The four horsemen of the Bitcoin apocalypse

All these things will happen within one to three months:

In the most optimal case Segregated Witness prevents us from hitting the hard-limit, and the release of new chips keeps difficulty rising despite the halving. The best case scenario would see Bitcoin chug along without any disruption whatsoever.

But there seems to be a calm before the storm, with difficulty and priceflatlining. And whatever side you are on, you can’t be certain what is going to happen next. Because we are going where no man has gone before.

For a currency which we invested billions of dollars into, that should make any Bitcoiner feel at least a bit uneasy. If that wasn’t yet the case, then read on.

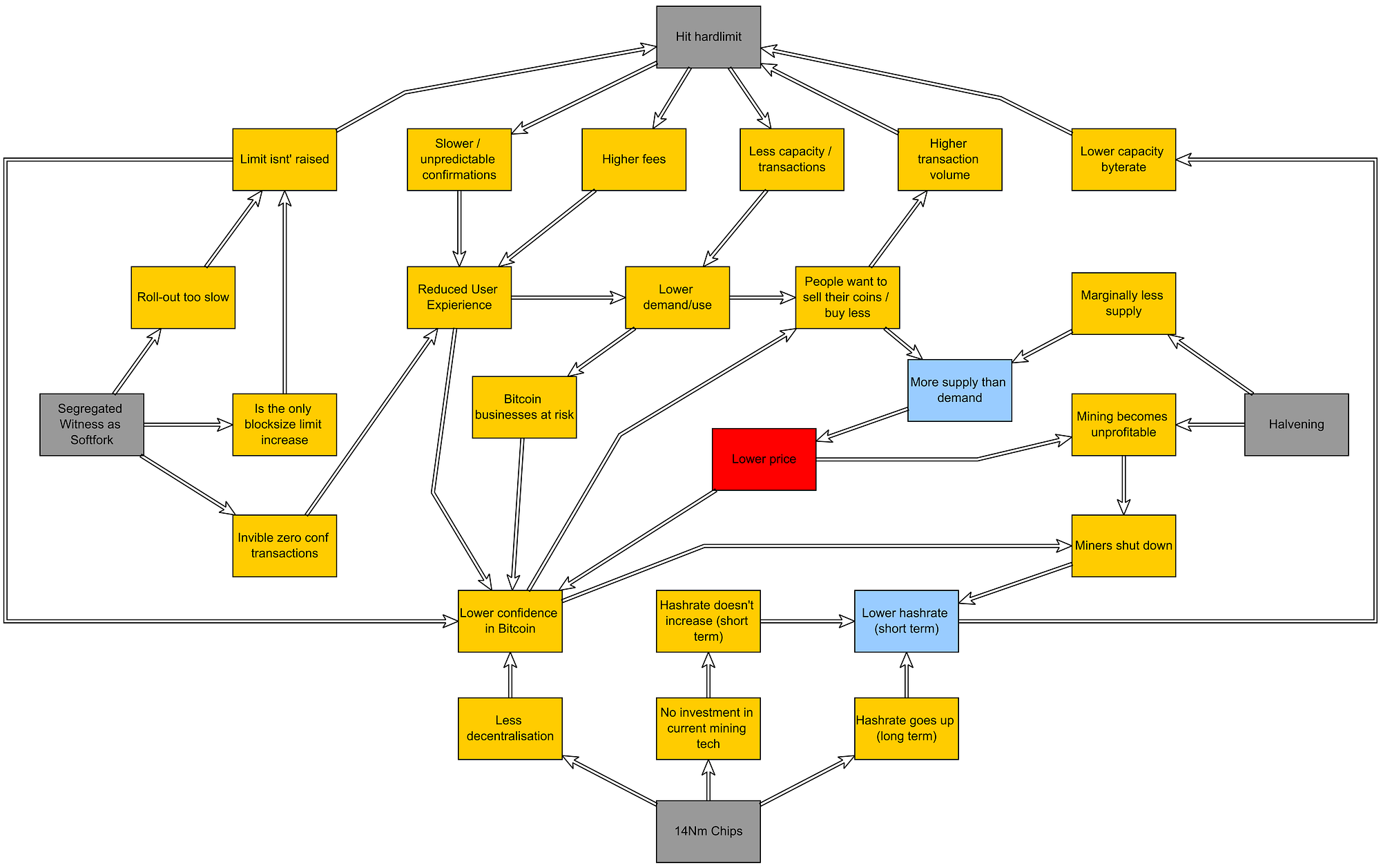

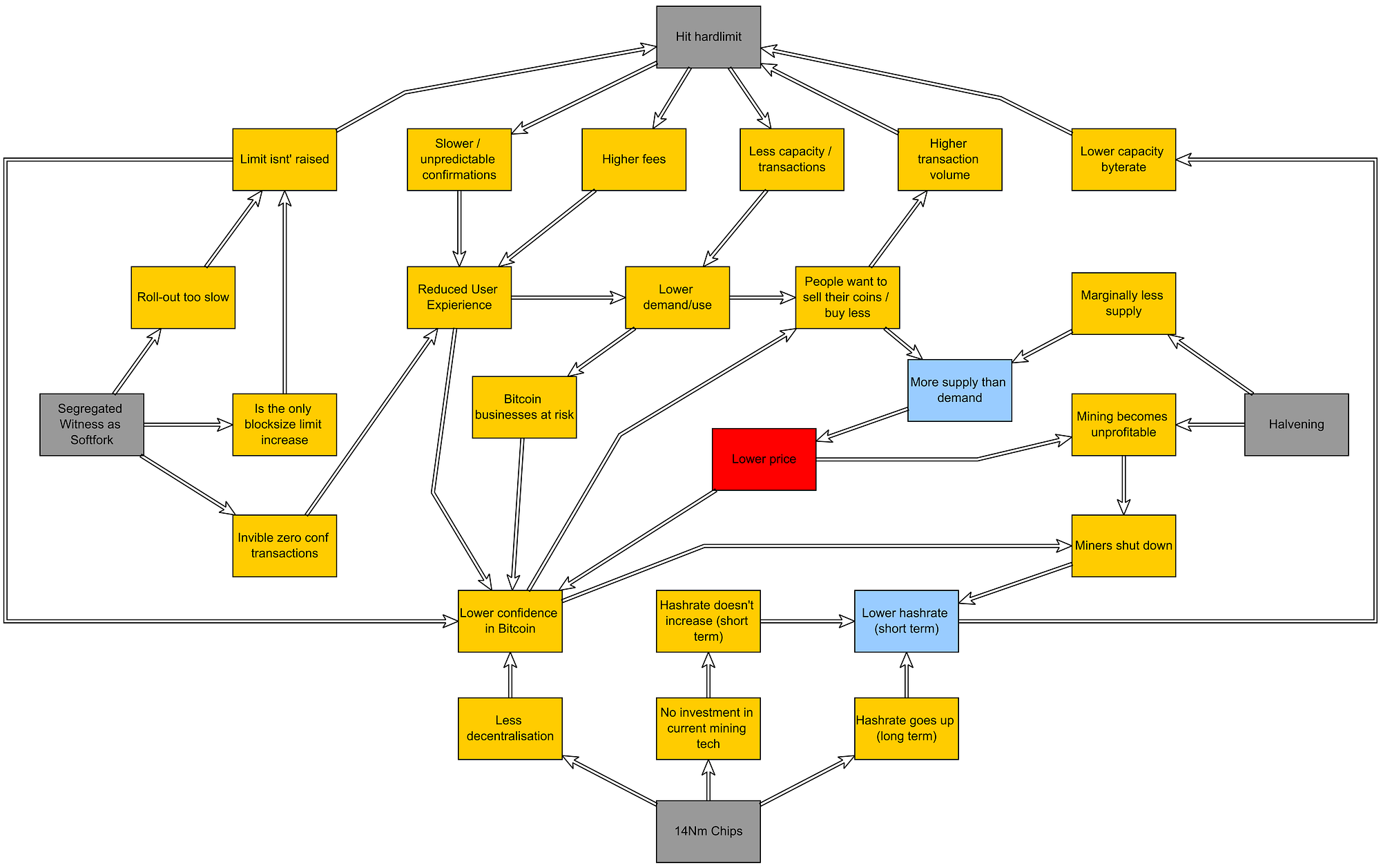

The worst case scenario would be that these four big events don’t cancel each other out, but that together they become even worse. That could go something like this:

Likewise miners which would continue mining at a loss just because Bitcoin might appreciate in the future is also not sustainable. Because at one point it would make more sense to buy Bitcoin directly than mine them at a loss.

But ultimately there are probably way too many people invested in Bitcoin who want to see it succeed. And that would create a huge reality distortion field, where even the worst things are spun around as good things. But don’t be surprised if the bubble pops at one point if usability is neglected much longer.

The four horsemen of the Bitcoin apocalypse

All these things will happen within one to three months:

In the most optimal case Segregated Witness prevents us from hitting the hard-limit, and the release of new chips keeps difficulty rising despite the halving. The best case scenario would see Bitcoin chug along without any disruption whatsoever.

But there seems to be a calm before the storm, with difficulty and priceflatlining. And whatever side you are on, you can’t be certain what is going to happen next. Because we are going where no man has gone before.

For a currency which we invested billions of dollars into, that should make any Bitcoiner feel at least a bit uneasy. If that wasn’t yet the case, then read on.

The worst case scenario would be that these four big events don’t cancel each other out, but that together they become even worse. That could go something like this:

- Hitting the hard limit would hurt usability, with higher fees and worse confirmation times

- Segregated Witness and wallet support is too slow and would not be an effective blocksize limit increase any time soon

- Wallets which do send Segregated Witness transactions create usability problems of their own (because other wallets won’t see transactions coming in until confirmed)

- Worsened usability hurts Bitcoin’s price

- 14 Nm chips hurts decentralisation, as they go to big miners first

- Worsened decentralisation hurts Bitcoin’s price

- Because of lack of confidence & price drop & halving & 14 Nm chips bound to become available miners would stop mining

- Any drop in hashrate would exaggerate hitting the hard limit, and cause more usability problems & loss of confidence

- Loss of confidence would make the price drop even more

- All this would make people simply use Bitcoin less, which in turn would hurt all Bitcoin businesses

- Etc. etc.

Likewise miners which would continue mining at a loss just because Bitcoin might appreciate in the future is also not sustainable. Because at one point it would make more sense to buy Bitcoin directly than mine them at a loss.

But ultimately there are probably way too many people invested in Bitcoin who want to see it succeed. And that would create a huge reality distortion field, where even the worst things are spun around as good things. But don’t be surprised if the bubble pops at one point if usability is neglected much longer.