DIF Candidates are invited to post in this thread. Thank you.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2021 DIF Candidate Announcement Thread

- Thread starter AgnewPickens

- Start date

- Status

- Not open for further replies.

AshFrancis

Member

Candidate Full Name:

Ash Francis

Most well-known/preferred aliases:

Ash

Contact:

[email protected]

Ash#8776 (discord)

@AshFrancis (telegram)

Dash Involvement:

Masternode Owner, Proposal Owner, Trust Protector, Incubator Admin.

DIF Supervisor Questionnaire:

How long have you been actively involved with Dash and the Dash community and in what ways have you helped the network previously?

I have been a Dash investor since 2016, after watching Evan announce Evolution at a Bitcoin Wednesday conference. Since that time, I have focused my life on Dash, from investing all my savings in it to become a Masternode Owner, to dedicating all my time (personal and work!) to its success.

Dash has an amazing potential to change the world, from its groundbreaking technology like InstantSend, LLMQs, and soon Platform, Drive, and DashPay to the DAO, community, inroads into Venezuela, governance systems, and more.

My time in Dash has been spent putting countless hours into volunteering for the community, donating thousands of dollars to causes that will help Dash succeed, helping proposal owners, answering questions, troubleshooting issues, assisting DCG, and building projects I believe will benefit Dash and providing my insight wherever I can help.

As an MNO, Proposal Owner, Incubator Admin, and outgoing Trust Protector, I have insight into all aspects of Dash and its greater ecosystem. I put many unpaid hours into all these roles to best serve Dash, and I do so willingly and happily – I’ve never felt more positive about the success of Dash since having taken such an active role in it!

What made you decide to apply for the Supervisor role?

I have been involved in the start-up space for over 6 years, having worked running the marketing at a small start-up that grew 300% over my tenure to starting my own, which is now in an accelerator. I have raised seed capital, met many VCs, pitched, and understand a great deal of the workings of the space which makes me a useful reference for the other supervisors and someone with access to both opportunities and insight.

In the last DIF Supervisor election, there were slots unfilled due to a lack of candidates – which thankfully were in turn awarded to great candidates. I recommended Rodrigo to the DIF chair at the time, and I was thrilled to see him take up the mantle, giving us access to new markets that have already yielded investment opportunities with huge potential. Ryan is an ideal supervisor and the DIF as it currently stands is very strong. Albeit missing some more serious fund management experience (which will come with greater assets under management and the budget to afford such talent). I believe it is important that the network has choices and put my candidacy forth as such. On this note, however, once the candidates are listed, I will review them, if my running would cause someone to leave who I think adds more value than myself (for example; if Ryan chose not to run in the election, but still wanted to stay on) then I will withdraw myself.

I’m very grateful for the opportunity and all the ongoing support I’ve received over my years in Dash and I will continue to serve the network in any capacity I can.

Ash Francis

Most well-known/preferred aliases:

Ash

Contact:

[email protected]

Ash#8776 (discord)

@AshFrancis (telegram)

Dash Involvement:

Masternode Owner, Proposal Owner, Trust Protector, Incubator Admin.

DIF Supervisor Questionnaire:

How long have you been actively involved with Dash and the Dash community and in what ways have you helped the network previously?

I have been a Dash investor since 2016, after watching Evan announce Evolution at a Bitcoin Wednesday conference. Since that time, I have focused my life on Dash, from investing all my savings in it to become a Masternode Owner, to dedicating all my time (personal and work!) to its success.

Dash has an amazing potential to change the world, from its groundbreaking technology like InstantSend, LLMQs, and soon Platform, Drive, and DashPay to the DAO, community, inroads into Venezuela, governance systems, and more.

My time in Dash has been spent putting countless hours into volunteering for the community, donating thousands of dollars to causes that will help Dash succeed, helping proposal owners, answering questions, troubleshooting issues, assisting DCG, and building projects I believe will benefit Dash and providing my insight wherever I can help.

As an MNO, Proposal Owner, Incubator Admin, and outgoing Trust Protector, I have insight into all aspects of Dash and its greater ecosystem. I put many unpaid hours into all these roles to best serve Dash, and I do so willingly and happily – I’ve never felt more positive about the success of Dash since having taken such an active role in it!

What made you decide to apply for the Supervisor role?

I have been involved in the start-up space for over 6 years, having worked running the marketing at a small start-up that grew 300% over my tenure to starting my own, which is now in an accelerator. I have raised seed capital, met many VCs, pitched, and understand a great deal of the workings of the space which makes me a useful reference for the other supervisors and someone with access to both opportunities and insight.

In the last DIF Supervisor election, there were slots unfilled due to a lack of candidates – which thankfully were in turn awarded to great candidates. I recommended Rodrigo to the DIF chair at the time, and I was thrilled to see him take up the mantle, giving us access to new markets that have already yielded investment opportunities with huge potential. Ryan is an ideal supervisor and the DIF as it currently stands is very strong. Albeit missing some more serious fund management experience (which will come with greater assets under management and the budget to afford such talent). I believe it is important that the network has choices and put my candidacy forth as such. On this note, however, once the candidates are listed, I will review them, if my running would cause someone to leave who I think adds more value than myself (for example; if Ryan chose not to run in the election, but still wanted to stay on) then I will withdraw myself.

I’m very grateful for the opportunity and all the ongoing support I’ve received over my years in Dash and I will continue to serve the network in any capacity I can.

AshFrancis

Member

Is it possible to have an explanation of the relationship between the Dash Investment Foundation and Ash's company Astound Group Ltd? From what I understand, Ash offered equity to the DIF at one point. What is the state of those negotiations? Thank you in advance.

We gave 10% equity in Astound Group Ltd to the DIF, which has been verified by Dash Watch (see their May report). I had asked about this before and there was no conflict of interest as any conversation around my business I would recuse myself from (worth noting, we haven't received any funding from the DIF and I gave the equity as an act of goodwill).

Geert

Active member

The "verification" link for this on the DashWatch site is broken. From what I understand, your agreement with the DIF was contingent upon you converting Astound Group Ltd to a different type of corporation so that the transfer of equity could be effected. Can you comment on that?

The "verification" link for this on the DashWatch site is broken. From what I understand, your agreement with the DIF was contingent upon you converting Astound Group Ltd to a different type of corporation so that the transfer of equity could be effected. Can you comment on that?

@Geert , please allow other DIF Candidates to have a chance to post, this is not an AMA thread.

Last edited:

Darren

Active member

The DIF is an owner of 10% equity of Astound. Ash has cooperated with my own verification process as I prepare for the DIF Q2 report.

We gave 10% equity in Astound Group Ltd to the DIF, which has been verified by Dash Watch (see their May report). I had asked about this before and there was no conflict of interest as any conversation around my business I would recuse myself from (worth noting, we haven't received any funding from the DIF and I gave the equity as an act of goodwill).

Sven

Member

Hi all, the page for the election is up https://dashwatch.org/elections and you'll find my name on there at the bottom. I sure hope that's not indicative of the result I'm gonna get once the election is over! ;-)

Profiles should be posted there soon. In the meantime, if anyone has any questions or comments - shoot!

Profiles should be posted there soon. In the meantime, if anyone has any questions or comments - shoot!

Who is name3? Besides, they are 5th on the list, not third.

Going to post your Candidate profile here since you have respondedHi all, the page for the election is up https://dashwatch.org/elections and you'll find my name on there at the bottom. I sure hope that's not indicative of the result I'm gonna get once the election is over! ;-)

Profiles should be posted there soon. In the meantime, if anyone has any questions or comments - shoot!

mastermined

Well-known member

How many DIF supervisors will be elected?

How many DIF supervisors will be elected?

6

Sven

Member

A question came up on Telegram and I'll put the answer here for better visibility:

"Thanks! I read yours. It tells about your background and relevant credentials but not what direction you would want the DIF to take; what kind of investments you would push for and the like."

Good question. The profile sections were given by Dash Watch and didn't get into goals and intentions. But of course that's important in any election.

I could answer with a one-liner - transactions! - but to address the "and the like" part and give a better picture to everyone wondering how I'm wired, let me digress a bit.

I often read comments like "Dash is hugely undervalued!" I understand people are unhappy with the price (so am I!), but - gasp! - I disagree with that statement.

To determine if something is undervalued, we first have to define what value is. Value investing is actually a common investment strategy. It means identifying investment targets that are undervalued and then holding them longterm. Sounds familiar? But value here is defined by fundamentals - clearly measurable indicators such as revenue, profit, cash flow, assets, expense ratios etc. Dash doesn't have any of that. How could it? It's not a company stock, after all.

But if we can't clearly measure value, we can hardly claim that something is under or overvalued. Some might argue that Dash is priced based on potential, expectations of future usefulness. I also call that hopium. At the end of the day, that's pretty much the definition of speculation. A long way from value. Prices based on speculation swing wildly up and down, depending on how strong the hopium is that day and on herd mentality, things like FOMO, with nothing dampening those swings or providing some guard rails for where the price truly should be. And at the whims of nothing but speculation, Dash, like other cryptos, is priced exactly where the speculators see it. Which means it's priced exactly right, at the equilibrium of supply and demand.

Not a very satisfying situation. But how can we change it? What could provide actual value for Dash?

To me, the answer is very clear: Widespread economic use. Unlike BTC-maximalists today, who have gone through a remarkable transformation from championing P2P electronic cash to exclusively promoting digital gold and store of value, I see no reason why a cryptocurrency couldn't be both. Facilitating easy, fast, cheap transactions has value. A medium of exchange is a valuable service, just look at Paypal. That service puts a floor in the value of the currency itself and that floor will rise the more the currency is being used, making it a great store of value as well.

My economics classes are a few years past by now, but I believe this is supported by the Quantity Theory of Money, one of the central building blocks of economics. It has its fair share of criticism, but it works for our purposes.

The Equation of Exchange at the heart of the theory says:

M x V = P x Q

M = Money supply

V = Velocity of money

P = Price level

Q = Quantity of all goods bought and sold, sometimes actually also labeled T for aggregate transactions.

Outside of crypto, lots of discussions revolve around the implications for M and how it can or should be used to regulate P (inflation) or stimulate Q (GDP). But in a fixed-supply crypto like Dash, M is fixed. Velocity means how frequently the same coin is used to pay for something in a given time. Hodling drives V down, rapid spending drives it up. But especially as long as crypto coexists with fiat currencies, there's an upper limit on velocity. Most merchants immediately exchange to fiat to pay their own bills and most people have to acquire crypto through exchanges, slowing down the roundtrip before the same coin can be spent again.

That leaves P and Q to keep the equation balanced. And clearly, the more transaction volume (Q up), the more price P will come down. Hooray!

Hold on, you say, wait a minute! We want price to go up, not down, you idiot!!

Sure, but you're thinking of the price of Dash expressed in fiat currency. This equation reflects the price of goods and services expressed in Dash. The relation is exactly reverse. The lower the prices of goods in Dash, the more you can buy with one Dash, the more valuable is Dash.

An example to illustrate, which I shamelessly lifted from my Reddit history: Currently, there are around 10m Dash in circulation. Actually, let's say 5m because the other half is locked up in Masternodes. For easier math, let's say the price is US$ 100/Dash.

Suppose Acme sells widget for $100 in fiat and accepts Dash, so widget costs 1 Dash. Widget is popular. 5 million people across the world want to buy it per day. They buy up the entire supply of free Dash, pay for the widget and Acme converts back to fiat the same day. Price overall didn't move.

Now widget gets even more popular. 10m people want to buy one, new competitors spring up who make them. But there simply aren't enough Dash to go around to let everyone have 1 whole Dash. The most everyone can have is 0.5 Dash. Acme and the competitors still want to sell widgets. No problem. Widget's Dash price adjusts down to 0.5 and 10 million widgets are sold and converted to fiat as before.

Now half a Dash buys a $100-widget, i.e the price is now $200/Dash.

The beauty of this is, that this is MUCH more sustainable than speculation-based valuation. Instead of the moods and whims of fickle speculators, this is based on real economic activity, which fluctuates much less.

Some people may actually prefer the whiplash of roller coaster markets, since you can make a fortune if you're lucky. (Or lose your last shirt if you're not.) But I think that's poison for large-scale mainstream adoption. I want to see a functioning, widely used P2P digital cash and I know the coin which makes that race has a huge sustainable upside in value that should make every hodler happy. I want Dash to be that coin.

So that should make it very clear what I would aim for as DIF supervisor: transactions, transactions, transactions. Not simply blockchain transactions - moving Dash back and forth between exchanges or your desktop and mobile wallets. I mean transactions that represent real economic activity measured both in number and value.

I will favor investments in companies that align with this goal. Craypay is a good example, even though I have some reservations about the gift card detour concept. Of course, the DIF is not a charity, so the prospects for good ROI are important too. We're not going to hand out money just for transactions alone. Good team, good track record, good product-market fit - all count.

"Thanks! I read yours. It tells about your background and relevant credentials but not what direction you would want the DIF to take; what kind of investments you would push for and the like."

Good question. The profile sections were given by Dash Watch and didn't get into goals and intentions. But of course that's important in any election.

I could answer with a one-liner - transactions! - but to address the "and the like" part and give a better picture to everyone wondering how I'm wired, let me digress a bit.

I often read comments like "Dash is hugely undervalued!" I understand people are unhappy with the price (so am I!), but - gasp! - I disagree with that statement.

To determine if something is undervalued, we first have to define what value is. Value investing is actually a common investment strategy. It means identifying investment targets that are undervalued and then holding them longterm. Sounds familiar? But value here is defined by fundamentals - clearly measurable indicators such as revenue, profit, cash flow, assets, expense ratios etc. Dash doesn't have any of that. How could it? It's not a company stock, after all.

But if we can't clearly measure value, we can hardly claim that something is under or overvalued. Some might argue that Dash is priced based on potential, expectations of future usefulness. I also call that hopium. At the end of the day, that's pretty much the definition of speculation. A long way from value. Prices based on speculation swing wildly up and down, depending on how strong the hopium is that day and on herd mentality, things like FOMO, with nothing dampening those swings or providing some guard rails for where the price truly should be. And at the whims of nothing but speculation, Dash, like other cryptos, is priced exactly where the speculators see it. Which means it's priced exactly right, at the equilibrium of supply and demand.

Not a very satisfying situation. But how can we change it? What could provide actual value for Dash?

To me, the answer is very clear: Widespread economic use. Unlike BTC-maximalists today, who have gone through a remarkable transformation from championing P2P electronic cash to exclusively promoting digital gold and store of value, I see no reason why a cryptocurrency couldn't be both. Facilitating easy, fast, cheap transactions has value. A medium of exchange is a valuable service, just look at Paypal. That service puts a floor in the value of the currency itself and that floor will rise the more the currency is being used, making it a great store of value as well.

My economics classes are a few years past by now, but I believe this is supported by the Quantity Theory of Money, one of the central building blocks of economics. It has its fair share of criticism, but it works for our purposes.

The Equation of Exchange at the heart of the theory says:

M x V = P x Q

M = Money supply

V = Velocity of money

P = Price level

Q = Quantity of all goods bought and sold, sometimes actually also labeled T for aggregate transactions.

Outside of crypto, lots of discussions revolve around the implications for M and how it can or should be used to regulate P (inflation) or stimulate Q (GDP). But in a fixed-supply crypto like Dash, M is fixed. Velocity means how frequently the same coin is used to pay for something in a given time. Hodling drives V down, rapid spending drives it up. But especially as long as crypto coexists with fiat currencies, there's an upper limit on velocity. Most merchants immediately exchange to fiat to pay their own bills and most people have to acquire crypto through exchanges, slowing down the roundtrip before the same coin can be spent again.

That leaves P and Q to keep the equation balanced. And clearly, the more transaction volume (Q up), the more price P will come down. Hooray!

Hold on, you say, wait a minute! We want price to go up, not down, you idiot!!

Sure, but you're thinking of the price of Dash expressed in fiat currency. This equation reflects the price of goods and services expressed in Dash. The relation is exactly reverse. The lower the prices of goods in Dash, the more you can buy with one Dash, the more valuable is Dash.

An example to illustrate, which I shamelessly lifted from my Reddit history: Currently, there are around 10m Dash in circulation. Actually, let's say 5m because the other half is locked up in Masternodes. For easier math, let's say the price is US$ 100/Dash.

Suppose Acme sells widget for $100 in fiat and accepts Dash, so widget costs 1 Dash. Widget is popular. 5 million people across the world want to buy it per day. They buy up the entire supply of free Dash, pay for the widget and Acme converts back to fiat the same day. Price overall didn't move.

Now widget gets even more popular. 10m people want to buy one, new competitors spring up who make them. But there simply aren't enough Dash to go around to let everyone have 1 whole Dash. The most everyone can have is 0.5 Dash. Acme and the competitors still want to sell widgets. No problem. Widget's Dash price adjusts down to 0.5 and 10 million widgets are sold and converted to fiat as before.

Now half a Dash buys a $100-widget, i.e the price is now $200/Dash.

The beauty of this is, that this is MUCH more sustainable than speculation-based valuation. Instead of the moods and whims of fickle speculators, this is based on real economic activity, which fluctuates much less.

Some people may actually prefer the whiplash of roller coaster markets, since you can make a fortune if you're lucky. (Or lose your last shirt if you're not.) But I think that's poison for large-scale mainstream adoption. I want to see a functioning, widely used P2P digital cash and I know the coin which makes that race has a huge sustainable upside in value that should make every hodler happy. I want Dash to be that coin.

So that should make it very clear what I would aim for as DIF supervisor: transactions, transactions, transactions. Not simply blockchain transactions - moving Dash back and forth between exchanges or your desktop and mobile wallets. I mean transactions that represent real economic activity measured both in number and value.

I will favor investments in companies that align with this goal. Craypay is a good example, even though I have some reservations about the gift card detour concept. Of course, the DIF is not a charity, so the prospects for good ROI are important too. We're not going to hand out money just for transactions alone. Good team, good track record, good product-market fit - all count.

Last edited:

Sven

Member

As if the above post wasn't long enough yet, let me add a few more thoughts.

There are voices that call for immediate action from the DIF to support the Dash price, some even going so far as asking the DIF to sell assets and buy Dash. Again, let me refer to my Reddit history on that, you see my reply right underneath the linked post.

Even if watching the price drop is painful, I believe for the DIF to make panicky steps to try and countersteer would be not only naive and foolish, but also ultimately futile and self-destructive.

I see the DIF along the lines of an angel investor or VC. It is designed to allow the network to participate in the success of commercial Dash-funded projects in a way the treasury alone never could. Too often, commercial projects gladly took DAO funding only to give us the short end of the stick once they were up and running.

Case study:

Livingroom of Satoshi

Funded in 2016 with 1000 Dash it has become a seemingly successful business: https://www.livingroomofsatoshi.com/graphs How much profit share does Dash get from it? Zero. Now look at their website again and see if you find Dash on there. I'll wait ... Found it? Yea, me neither. Why has it disappeared? I don't know. But I do know that cases like this should not happen again.

The DIF and the treasury should both focus on projects with a clear benefit for Dash. That's a given. The difference is in the expectation of a financial return.

The treasury is giving away money as a gift with no enforceable obligations to the recipient once it has been paid out. That's suitable for cost-heavy projects without direct profit. Open-source software development, events, marketing campaigns etc.

But why should Dash gift money to startup founders who hope to create a profitable enterprise and ultimately obtain personal wealth from their success? That's where the DIF comes in. By providing capital in return for equity, not only will we all benefit from the success of our portfolio companies, but we will also be able to ensure alignment with Dash long past the initial investment.

We all have to be very clear, though, that this is a long-term play. You can't invest in a startup today and pull the rug from under its feet tomorrow. This shouldn't really come as a surprise to any crypto veteran familiar with the "hodl" meme. It applies in startup funding just as much. Only here investors are even contractually tied to their investment until an exit event occurs. And "Dash price is dropping!" ain't one.

We also have to be clear that startups often have a long ramp-up time before they generate profit. Facebook took 5 years. Amazon took 7. Exit events can happen earlier, but it should be very clear that everyone wanting to see returns or even calling the DIF a failure after a year or two of operations needs a reality check of his/her expectations.

I was one of the early employees in a startup called TubeMogul. Years later, the company was sold for $540m to Adobe providing a very nice payday for everyone. We would never have made it there if our early investors had let us hang out to dry.

However, this is not to say that the DIF has carte blanche to absorb funds from the treasury at will. We often pride ourselves of having a self-funding network. It's one of the main differentiators from BCH or LTC. It's also only half the truth.

The DIF receives hundreds of Dash each funding round, 70% of which get liquidated to USD according to the last report. Together with DCG funding, most of which is also converted to fiat, this puts significant sell pressure on Dash. Between the DIF and DCG, each month hundreds of thousands of dollars of fresh fiat money have to flow into the Dash ecosystem just to keep the price stable.

If that fresh outside money doesn't flow, price drops, which can put us into a vicious cycle of diminishing investor confidence, even less money flowing, even lower prices and ultimately less funding. That means the onus is on the DIF and DCG to at least provide enough value to the network to offset price dips from budget sales.

Of course it's easy to point fingers at the overall crypto market now: "Hey look, everything's tanking! We can't stem that tide!" Sorry, no cop-outs! Investors will be familiar with the concept of "alpha", a measure of performance against the overall market. For simplicity, we can use the DASH/BTC rate or the DASH/BCH rate as an approximation. DIF and DCG should work towards keeping those rates at least stable if not rising=outperform.

Still, I won't make this post about DCG performance and I stand by what I said earlier about the DIF. The DIF is not in a 100m sprint, it's in a marathon. And with a couple hundred $k AUM, it's barely viable as an investor. It needs significantly more firepower. Angel/VC investing is inherently very risky. 90% of average angel investments result in a loss, a good half of that in total loss. Of the remaining 10%, most will make a little money beyond the initial investment and probably less than 2% will become outsize successes. I'm already bracing for impatient MNOs calling DIF a failure when the first investment dies. Which will inevitably happen. But like it or not, that means we do need a whole portfolio of companies to have a decent chance at catching one of those superstars that end up moving the needle for the entire Dash network.

So, for better or for worse, we will still be in the fundraising stage for quite a while, yet we need to strike a careful balance between loading up fast enough to play with the grown-ups and putting too much pressure on the network when its already under stress.

I promise I'll shut up now!

There are voices that call for immediate action from the DIF to support the Dash price, some even going so far as asking the DIF to sell assets and buy Dash. Again, let me refer to my Reddit history on that, you see my reply right underneath the linked post.

Even if watching the price drop is painful, I believe for the DIF to make panicky steps to try and countersteer would be not only naive and foolish, but also ultimately futile and self-destructive.

I see the DIF along the lines of an angel investor or VC. It is designed to allow the network to participate in the success of commercial Dash-funded projects in a way the treasury alone never could. Too often, commercial projects gladly took DAO funding only to give us the short end of the stick once they were up and running.

Case study:

Livingroom of Satoshi

Funded in 2016 with 1000 Dash it has become a seemingly successful business: https://www.livingroomofsatoshi.com/graphs How much profit share does Dash get from it? Zero. Now look at their website again and see if you find Dash on there. I'll wait ... Found it? Yea, me neither. Why has it disappeared? I don't know. But I do know that cases like this should not happen again.

The DIF and the treasury should both focus on projects with a clear benefit for Dash. That's a given. The difference is in the expectation of a financial return.

The treasury is giving away money as a gift with no enforceable obligations to the recipient once it has been paid out. That's suitable for cost-heavy projects without direct profit. Open-source software development, events, marketing campaigns etc.

But why should Dash gift money to startup founders who hope to create a profitable enterprise and ultimately obtain personal wealth from their success? That's where the DIF comes in. By providing capital in return for equity, not only will we all benefit from the success of our portfolio companies, but we will also be able to ensure alignment with Dash long past the initial investment.

We all have to be very clear, though, that this is a long-term play. You can't invest in a startup today and pull the rug from under its feet tomorrow. This shouldn't really come as a surprise to any crypto veteran familiar with the "hodl" meme. It applies in startup funding just as much. Only here investors are even contractually tied to their investment until an exit event occurs. And "Dash price is dropping!" ain't one.

We also have to be clear that startups often have a long ramp-up time before they generate profit. Facebook took 5 years. Amazon took 7. Exit events can happen earlier, but it should be very clear that everyone wanting to see returns or even calling the DIF a failure after a year or two of operations needs a reality check of his/her expectations.

I was one of the early employees in a startup called TubeMogul. Years later, the company was sold for $540m to Adobe providing a very nice payday for everyone. We would never have made it there if our early investors had let us hang out to dry.

However, this is not to say that the DIF has carte blanche to absorb funds from the treasury at will. We often pride ourselves of having a self-funding network. It's one of the main differentiators from BCH or LTC. It's also only half the truth.

The DIF receives hundreds of Dash each funding round, 70% of which get liquidated to USD according to the last report. Together with DCG funding, most of which is also converted to fiat, this puts significant sell pressure on Dash. Between the DIF and DCG, each month hundreds of thousands of dollars of fresh fiat money have to flow into the Dash ecosystem just to keep the price stable.

If that fresh outside money doesn't flow, price drops, which can put us into a vicious cycle of diminishing investor confidence, even less money flowing, even lower prices and ultimately less funding. That means the onus is on the DIF and DCG to at least provide enough value to the network to offset price dips from budget sales.

Of course it's easy to point fingers at the overall crypto market now: "Hey look, everything's tanking! We can't stem that tide!" Sorry, no cop-outs! Investors will be familiar with the concept of "alpha", a measure of performance against the overall market. For simplicity, we can use the DASH/BTC rate or the DASH/BCH rate as an approximation. DIF and DCG should work towards keeping those rates at least stable if not rising=outperform.

Still, I won't make this post about DCG performance and I stand by what I said earlier about the DIF. The DIF is not in a 100m sprint, it's in a marathon. And with a couple hundred $k AUM, it's barely viable as an investor. It needs significantly more firepower. Angel/VC investing is inherently very risky. 90% of average angel investments result in a loss, a good half of that in total loss. Of the remaining 10%, most will make a little money beyond the initial investment and probably less than 2% will become outsize successes. I'm already bracing for impatient MNOs calling DIF a failure when the first investment dies. Which will inevitably happen. But like it or not, that means we do need a whole portfolio of companies to have a decent chance at catching one of those superstars that end up moving the needle for the entire Dash network.

So, for better or for worse, we will still be in the fundraising stage for quite a while, yet we need to strike a careful balance between loading up fast enough to play with the grown-ups and putting too much pressure on the network when its already under stress.

I promise I'll shut up now!

Last edited:

@Sven Thank you for this insight and I agree with you, especially the example of Livingroom of Satoshi.

However, I know you say this is a marathon but let's make it a half marathon please. The current DIF model is much too similar to the failed BBC licensing model. An almost guaranteed income from the treasury to fund ventures for profitable businesses elsewhere. No, I suggest that the DIF should be aiming to be a sustainable and profitable business. It needs to outgrow the need for financing while remaining loyal to the network.

However, I know you say this is a marathon but let's make it a half marathon please. The current DIF model is much too similar to the failed BBC licensing model. An almost guaranteed income from the treasury to fund ventures for profitable businesses elsewhere. No, I suggest that the DIF should be aiming to be a sustainable and profitable business. It needs to outgrow the need for financing while remaining loyal to the network.

Sven

Member

@Sven Thank you for this insight and I agree with you, especially the example of Livingroom of Satoshi.

However, I know you say this is a marathon but let's make it a half marathon please. The current DIF model is much too similar to the failed BBC licensing model. An almost guaranteed income from the treasury to fund ventures for profitable businesses elsewhere. No, I suggest that the DIF should be aiming to be a sustainable and profitable business. It needs to outgrow the need for financing while remaining loyal to the network.

What is the BBC licensing model and why has it failed? Not really familiar with it.

> "An almost guaranteed income from the treasury to fund ventures for profitable businesses elsewhere."

First let's be careful with the wording. I haven't looked closely at DIF accounting, but normally, the funding that an investment fund receives is not income for the fund.

Typically an angel/VC company would raise an investment fund with a specific target, say $10m. Individual investors can pay into that fund until the $10m are full. Then the fund closes, but is not income for the angel. Instead the fund is being invested in startups on behalf of the investors. Individual investments are at the discretion of the angel company as long as they follow the fund's investment thesis, which everyone agreed on beforehand. For its service, the angel will take a management fee and a portion of any profits once an exit occurs. Only that fee and the profit share are income for the angel. Keep in mind, the DIF supervisors work for free, so there isn't much management fee to speak of (some expenses for legally required directors).

Individual investors in the fund see returns only once the successful portfolio companies have exits (acquisition, IPO, buy-out in later funding rounds etc.). That is how they benefit from "profitable businesses elsewhere". But this will take years and investors need to be comfortable with having their funds locked up during that time. In return, the paybacks for a patient investor can be huge, see my own TubeMogul experience above.

But, yes, "fund ventures for profitable businesses elsewhere" is the definition of what an investment company (or foundation) does. And isn't that what the network voted for when we established the Dash Investment Foundation? This purpose is also defined in the DIF constitution: "The primary purpose of this organization is to make investments in businesses... " The simple truth is, you can't run an investment business on a shorter time horizon than what it takes for such investments to mature.

Perhaps some MNOs at the time weren't really clear of what they got into. But if we agree that we want to have a Dash Investment Foundation with the stated purpose then we must also accept what that requires:

a) enough funding to build a portfolio of investments to offset inevitable failures and

b) enough time to see those investments through to maturity.

> "I suggest that the DIF should be aiming to be a sustainable and profitable business. It needs to outgrow the need for financing..."

Yes, of course it's aiming to be that. And it will be. Financing, too, will eventually come from the returns from investment exits. But again, it's unrealistic to expect that to happen after not even a year of operation - wasn't Ready Raider last Oct the 1st investment?

On the other hand, if you have specific suggestions what the DIF could do to accelerate returns, please share. It's easy to say "I want a profitable business with no further financing". Who wouldn't want that? It's much harder to come up with actual, workable ideas. It's likely such ideas would involve changing the entire concept of the DIF, in other words, take the "I" out of DIF. While I'm always open to new ideas, as of today, that's not what I'm running for.

Last edited:

Almost every household in the UK watching near live UK broadcasts - on any device, including TV - must by law pay a tax to the BBC. currently £159 every year. In return, they produce propaganda, repackage it and distribute it through privately held international companies. In other words, they get their content creation for free and then they use global advertising and merchandising to make profits. Fun fact, watching TV without a license will get you a criminal record and it's enforced via fines or prison sentence.

I was just answering your question but I'm happy to tell you my BP is rocketing because I hate them so much :-D

Thankfully, the DIF tax is not enforceable or guaranteed but I see parallels. I don't want the DIF being perpetually draining the dash treasury when it has gained enough funds to take care of itself. That, I think you agree, and I understand it probably won't happen for a couple of years.

And choose the semantics how you want but money from the dash treasury is literally an output from the dash blockchain going to the DIF input. Not producing that output has monetary value so the DIF needs to be more profitable.

I was just answering your question but I'm happy to tell you my BP is rocketing because I hate them so much :-D

Thankfully, the DIF tax is not enforceable or guaranteed but I see parallels. I don't want the DIF being perpetually draining the dash treasury when it has gained enough funds to take care of itself. That, I think you agree, and I understand it probably won't happen for a couple of years.

And choose the semantics how you want but money from the dash treasury is literally an output from the dash blockchain going to the DIF input. Not producing that output has monetary value so the DIF needs to be more profitable.

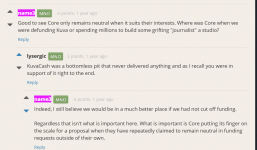

Who is name3? Besides, they are 5th on the list, not third.

That is a great question! name3 is a floating turd in the bowl that just cannot be readily flushed. He once applied for Trust Protector in it's formation round, lost and is now appying for DIF Supervisor and this is deeply unsettling to me given his track record as a staunch Kuvacash supporter and him being instrumental in the defunding of gems such as DASH FORCE NEWS.

I want to be damn clear, the swine name3 does not have my support for a DIF supervisor and it would be very bad if anyone voted for him because he will act to enrich himself and his goals and values are NOT aligned with the DASH network.

This piece of shit wrote a hit piece on DFN and has since tried to cover his tracks by deleting his post, you can see what is left of it here

Swine!

Filth!

Lies!

To read more of his garbage, enter this search term into the Discord search bar.

Code:

from: name3#5480 in: thunderdomeRecently Arden noticed we used to have a DASH News Site and wondered what happened to it since it was so successful and so well ranked.

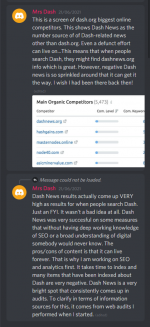

So, name3 was responsible in part for the destruction of one of the few well indexed excellent sources of news for DASH that was keeping the coin relevant and in the forefront of investor's minds and this turd bag is now coming back to run for DIF supervisor? my ass he is !

For additional information, we can query his dashcentral posts by running this query https://www.google.com/search?q=site:dashcentral.org+name3 which shows how he voted in the past and how he subverted some proposals.

For https://www.dashcentral.org/p/dash-force-q1-2020

and so on, really shameful stuff.

For https://www.dashcentral.org/p/dash-force-q1-2020

and so on, really shameful stuff.

- Status

- Not open for further replies.