June 4, 2022 2:53 am

June 4, 2022 2:53 am

Taxi toppers report: Miami

As the Dash community is aware, during the months of November and December 2021, the DCG marketing team set up an initiative to promote Dash, increase brand awareness and aim to increase DashDirect usage in a real world setting. The means selected for this effort was a car topper company in Miami, Florida.

Background:

Dash marketing has historically been limited in scope. There are multiple reasons for this, but the most prominent ones are a lack of funding for large marketing actions, and a historically risk averse mindset given the low budgeted amounts. Since 2018, whenever a budget has been available, expenditures related to conference booths or video ads have been prioritized.

In Q4 of 2021, given a slightly higher marketing budget since the 2018 bear market, the Dash marketing team searched for an awareness campaign distinct from what had been done in the past.

Given Dash’s success in obtaining awareness, press attention and interest in Latin America -particularly in Venezuela- and given the unique advantage of the DashDirect app, DCG’s Marketing manager searched for options that could be within a 50,000 USD range, could have some overlap with our previous efforts, and could allow for testing new, non-digital methods for promotion.

After considering different options, a car topper campaign was selected in the area of Doral, in the greater Miami area, the main considerations were:

- The city of Doral has the largest concentration of Venezuelans in the US. With 250,000 Venezuelans in the US, it’s estimated that around 10,000 of them live in Doral.

- Car toppers on Taxis represented a unique opportunity to run an experiment in a concentrated area where new users could have synergies with other LatAm activities we are pursuing.

- The cost was within the marketing budget at that time.

- The action could be scaled to other geographies if successful, and lessons could be shared with other Dash teams.

- Car toppers run an alternating sequence of ads on the units, and their technology allows for counting people in front of the unit, as an ad is displayed, therefore allowing to have an accurate count of impressions per unit

After 60 days of sponsoring the car toppers, we received the following datasets, one being from the advertising company VuGo, and the other one from the Android Dash wallet;

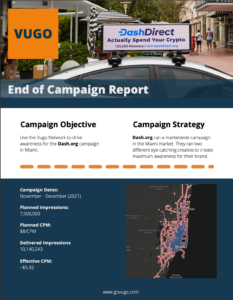

From the Vugo Out of home advertising company DCG received the following results:

Vugo results (See report at the bottom of blogpost):

As a point of comparison, research studies have repeatedly shown that out of home (OOH) is a low cost option for advertising. To reach 1,000 people, online can cost up to $17.50 per thousand impressions, magazines can cost up to $21.00 per thousand, and spot broadcast or cable can cost $22.00- $25.00 per thousand. At $3.38 – $8.65 per thousand impressions, OOH delivers the same audience at significantly lower cost. DashDirect Miami car topper campaign was on the lower end for average cost according to such research.(**1**)

From an usage and Dash behavior perspective, In order to measure the effect and usage on Dash wallets, we set up a more granular information set for Florida, or Miami when possible for the months of the Car topper campaign, and received the following datasets from Dash Android wallet store:

Total Nr of installed Wallets (Dash Mobile for Android)

Wallet actions in Miami Area

The data in android can only be considered a sample of the whole market, as around 60% of United State’s of America’s mobile users prefer IOs on their mobile units(**2**), but the android installs and usage displayed a large enough part of the market that can be extrapolated for conclusions as a campaign given the lack of a complete dataset.

In terms of DashDirect usage, given the nature of the app, there wasn’t a way to measure downloads of DashDirect in Miami, but the DashDirect data trends show no spike in data that would point to an increase adoption or increased usage of the DashDirect app during the Miami campaign.

Conclusion

Even though the results are analyzed with an incomplete set of data due to there not being an iOS dataset, I come to the conclusion that the Miami Car Topper marketing campaign was a good initiative to obtain brand exposure for Dash, and Dash Brand awareness as a cryptocurrency, as well as for DashDirect, but not powerful enough to drive new user behaviour for new people to begin using their Dash as P2P electronic Cash.

These kinds of actions as one offs, are not enough to modify people’s behavior, and get them to download the DashDirect app, the Dash Wallet, sign up to an exchange, and acquire Dash for spending. As we can conclude by seeing that even though the VuGo product over delivered on their CPM, this Dash branding exposure alone did not seem to impact positively the actual usage of already installed Dash wallets, nor the downloading of new wallets.

So it is correct to say that with these actions Dash obtained results on the initial two layers of what is called the “top of the marketing funnel”.

- Brand attention: People see a name

- Brand Awareness: People recognize a Brand because they have seen/heard before

- Brand knowledge: People know about the brand and it’s details

- Brand preference: People prefer and use the brand!

There are many lessons learned, and some of the suggestions that I am making for future OOH branding endeavors include:

- Such campaigns need to be more aggressive. Just the top of a car is not enough for what we need at this moment of Dash. As suggested on our discussion channels, such activities could be complemented with internal information in the cars, localized billboards, and more.

- There should be easier measurement tools included in the campaign. A QR code on some units or a code for redeeming 10 USD in Dash would have given more granularity between the impressions (hard data), and the usage in Miami (hard data). Just like any other sales funnel, there are many points in between, and being able to measure what else happened would help to fine tune the action.

-

There are endless options to improve the marketing campaign, as mentioned in Discord or Telegram these include:

- Use empty outside space. Hood wraps, side doors, bumper stickers, decals.

- Use indoor space. head rests, seat covers.

- Inform the drivers on how easy it is to accept Dash and how easy it is to re-spend Dash using DashDirect, specifically use cases such as vehicle maintenance

- QR-Codes, yes. the more the better. Taxi, Cab, RideShare Uber & Lyft related Business QR-codes that don’t necessarily change every new transaction.

- And then get the passengers involved either via Dash to Driver P2P Payments, Tips, or Savings through DashDirect.

Recommendations

Future campaigns need to be more aggressive in terms of communication tools and duration, including more than one OOH media, and such campaigns also need to consider better ways to measure cause-effect.

While most of these actions are common sense, the challenge is to find a way to deploy them with whatever budget is available.

- An interesting debate, considering points 1 and 3 in the conclusion segment is that maybe Dash should not run non-digital marketing campaigns until the budget reaches at least 3X what was spent this time. But that brings the debate of whether we are perpetuating a negative cycle in which our price is impacted by low brand awareness, which in turn creates less demand. What do you think?

The DashDirect Taxi Car topper campaign was an interesting experiment, and I am sure it will serve as a measurement point, and learning opportunity for future marketing campaigns.

In my personal opinion, Dash should continue trying out constantly efforts, with very different approaches, scrappy marketing activities, and measuring them against each other in order to:

- Keep some kind of brand awareness on the crypto market.

- Keep searching for an effective formula to get improved brand awareness.

- Influence larger Dash holders to also participate in marketing campaigns, as it is the case with non-proposal system coins such as Bitcoin, Doge and others, where larger holders run billboard campaigns because they want to contribute to their coins’ awareness.

—————

**1) https://oaaa.org/portals/0/public%20pdfs/take%20your%20message%20further.pdf

**2) https://gs.statcounter.com/os-market-share/mobile/united-states-of-america

—————

Vugo OOH report: